Chinese Yuan as Reserve Currency

Even before the sovereign debt crisis in Europe damped confidence in the world’s second most important reserve currency, the Chinese Yuan was on the cusp of being accepted as a global reserve currency.We’re all familiar with the arguments attacking the Yuan in this context: its currency is pegged, its capital controls are rigid, and its capital markets are shallow and illiquid. Say what you want about the world’s major currencies (volatile, debt-ridden, etc.), but at least none of these factors applies, goes this line of thinking. With the Euro’s future up in the air, however, a potential hole has been created in Central Banks’ respective forex reserves. As replacement(s) for the Euro are sought, such long-held assumptions are being challenged.

The Chinese Yuan is attractive for a number of reasons. First, investors and Central Banks want exposure to China’s economy; its average annual growth rate of 10% over the last 30 years is far-and-away the highest in the world. “China’s economic output will be more than $5 trillion, or around 9% of the world’s economy, according to the International Monetary Fund.” Second, the fact that the RMB is fixed is in some ways a perk: the wild fluctuations that most currencies witnessed as a result of the credit crisis has made some wonder if market-determined exchange rates aren’t overrated. Finally, the widespread consensus is that the RMB will appreciate anyway, so holding it seems like a safe bet.

Therefore, “Central banks or sovereign wealth funds from Malaysia, Norway and Singapore have received special quotas from the Chinese government to allow them to gain a bit of exposure to China’s currency. The bet is that holding yuan-denominated assets is an important feature of a diversified national reserve.” In addition, China has signed Yuan-denominated swap agreements with a handful of its most important trade partners, totaling $100 Billion over the last year.

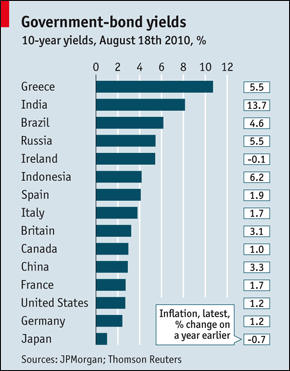

Still, these are small-scale agreements, and Central Banks are really just testing the waters. According to a recent study by the Reserve Bank of India (RBI), “The Chinese yuan is ‘far from ready’ to gain reserve currency status. Rather, it said China’s yuan was likely first to become a regional currency as trade links with its neighbours expand.” The main issue is not one of stability, but rather of supply. Simply, there are not enough liquid, attractive investments, denominated in RMB. China’s stock and bond markets are filled with unreliable companies, whose primary loyalty is to the State, rather than to investors. Buying Chinese government bonds seems like a safe option, but given, that China finances most of its spending with cash, such bonds are not widely available.

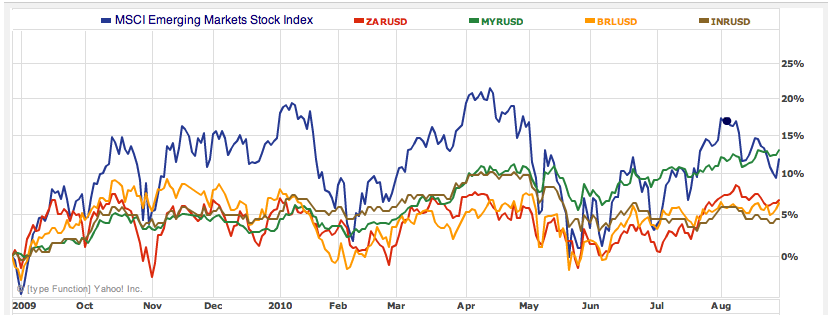

For now, the Chinese Yuan will remain most attractive (from the standpoint of a reserve currency) to regional trade partners, because such countries have a genuine use for RMB. Investors seem to understand this idea, and are using the currencies of such countries to bet indirectly on the RMB. According to one analyst, “On days when trading is especially volatile, the Singapore dollar moves in tandem with the yuan bets. The Malaysian ringgit, Taiwanese dollar and Korean won are also high on the list of currencies affected by the yuan.” In short, the RBI’s assessment of the Yuan seems pretty apt. It will probably be at least a decade before holding the Yuan is as viable (not to say attractive) as the Japanese Yen. For investors who don’t want to wait that long, there are a handful of other regional currencies that they can hold in the interim.

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.

I’m sure serious technical analysts are rolling their eyes at the chart above, but the point stands that trend-following has never been easier and rarely more profitable than it is now. One fund manager summarized, “Trend-following investors are capturing the momentum in several big currency moves. You have so much uncertainty in the world now with regard to inflation or deflation, which typically makes currency markets and interest rates move. That is good for trend followers as it causes volatility, which typically creates good profits.” In other words, there is a tremendous amount happening in forex markets at the moment, and this is reflected in protracted, deep moves in currency pairs, which can change direction without notice and yet continue moving the opposite way for just as long. If you think this sounds obvious, look at historical data (5-10 years) for the majority of currency pairs: while trends have always been abundant, it was only recently that they began to last longer and became more pronounced.