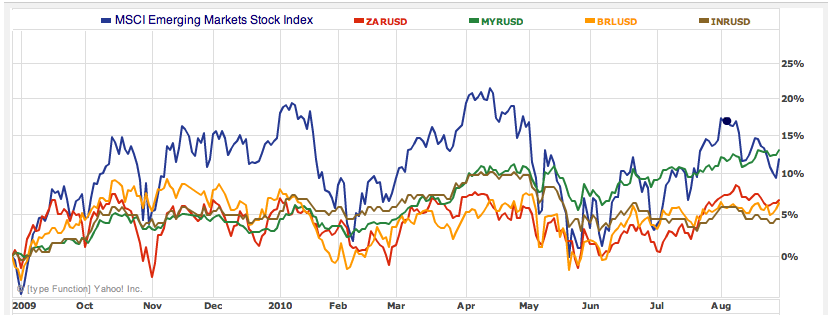

Emerging Market Currencies Flat in 2010

The recovery that emerging markets (their economies and financial markets) have staged since the lows of 2008 is impressive. In most corners of the financial markets, all of the losses have been erased, and securities/currencies are trading only slightly below there pre-credit crisis levels. Even compared to twelve months ago, in 2009, the performance of emerging market currencies holds up well. In the year-to-date, however, most of these currencies have appreciated only slightly, thanks to a particularly weak month of August.

On the other hand, emerging market debt – as proxied by the JP Morgan Emerging Market Bond Index (EMBI+) has been unbelievably strong. Prior to the slight correction in the last couple weeks, the index has risen a whopping 20% over the last twelve months. On the surface, this disconnect between stocks and bonds would seem to be an anomaly, or even a contradiction. After all, if investors are only lukewarm about emerging market currencies and stocks, what reason would there be for them to get so excited about bonds.

When it comes to debt, emerging markets have actually outperformed G7 debt, in spite of the current risk-averse climate. “Funds investing in emerging-market local-currency debt have attracted $16.9 billion of net inflows so far, more than triple the record annual intake of $5 billion recorded in 2007.” The logical basis for this shift is surprisingly straightforward: “When we look at government debt, we’re always comparing and contrasting the yields versus the fundamentals. I just don’t know why you would want those low yields from a Treasury bond in the developed world when you can get much higher yields — and in our estimation, an improving economic story — in Indonesia, Malaysia or Brazil.”

In other words, why would you want to earn 2.65% from a country (US) whose national debt is close to 100% of GDP, when you could earn double or triple that rate from investing in the sovereign debt of countries whose Debt-to-GDP ratios are sustainable?! In addition, when it comes to investing in debt, the lack of volatility in emerging market currencies can bee seen as a plus, since it prevents the interest rates from becoming diluted. To be fair, fundamentals don’t represent the whole story: “After 2008, you really have to take liquidity into consideration. Emerging markets are going to be some of the first to freeze up in a crisis.”

In fact, some analysts are already starting to question whether the markets haven’t gotten ahead of themselves in this regard, and that perhaps we are due for a big correction: “Come September, when trading resumes in earnest, we’ll find out if the cozy emerging markets world we have experienced over the past few months was summer laziness or strong conviction.” With vacations ending and traders set to return to their desks, we won’t have to wait long to find out.

No comments:

Post a Comment